Building a Foundation

An exploration of Heartland’s culture and core values uncovered where the credit union’s offerings intersected with the needs of its customers. In an industry where, according to recent studies, over 60% of consumers prefer digital banking solutions yet feel underserved by traditional banks, establishing a down-to-earth caregiver brand was essential. This approach provided key messages that helped consumers clearly distinguish Heartland’s distinctive benefits.

This position was anchored by the brand promise “It’s the Heartland Way,” which leads conversations about the unique benefits of the credit union and its commitment to the success of its members and the communities it serves.

Defining and Delivering on the Brand Promise

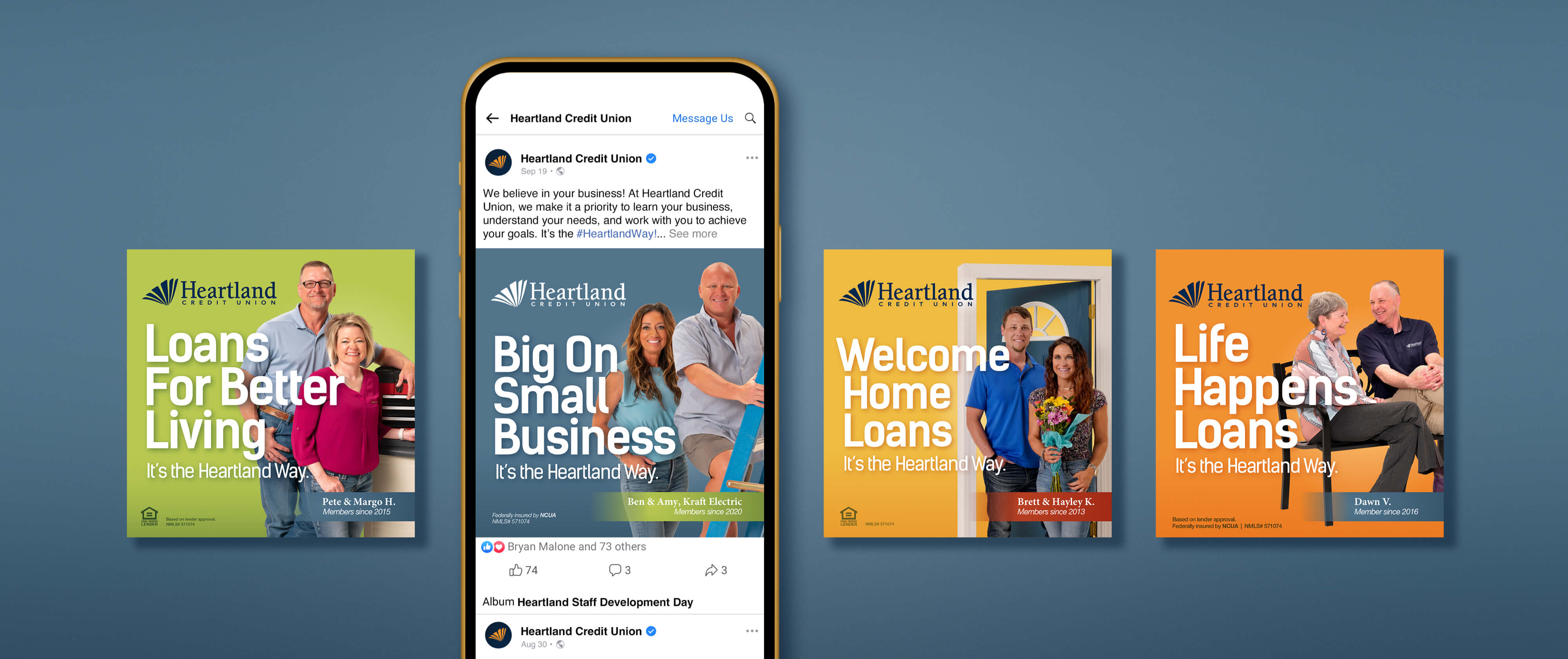

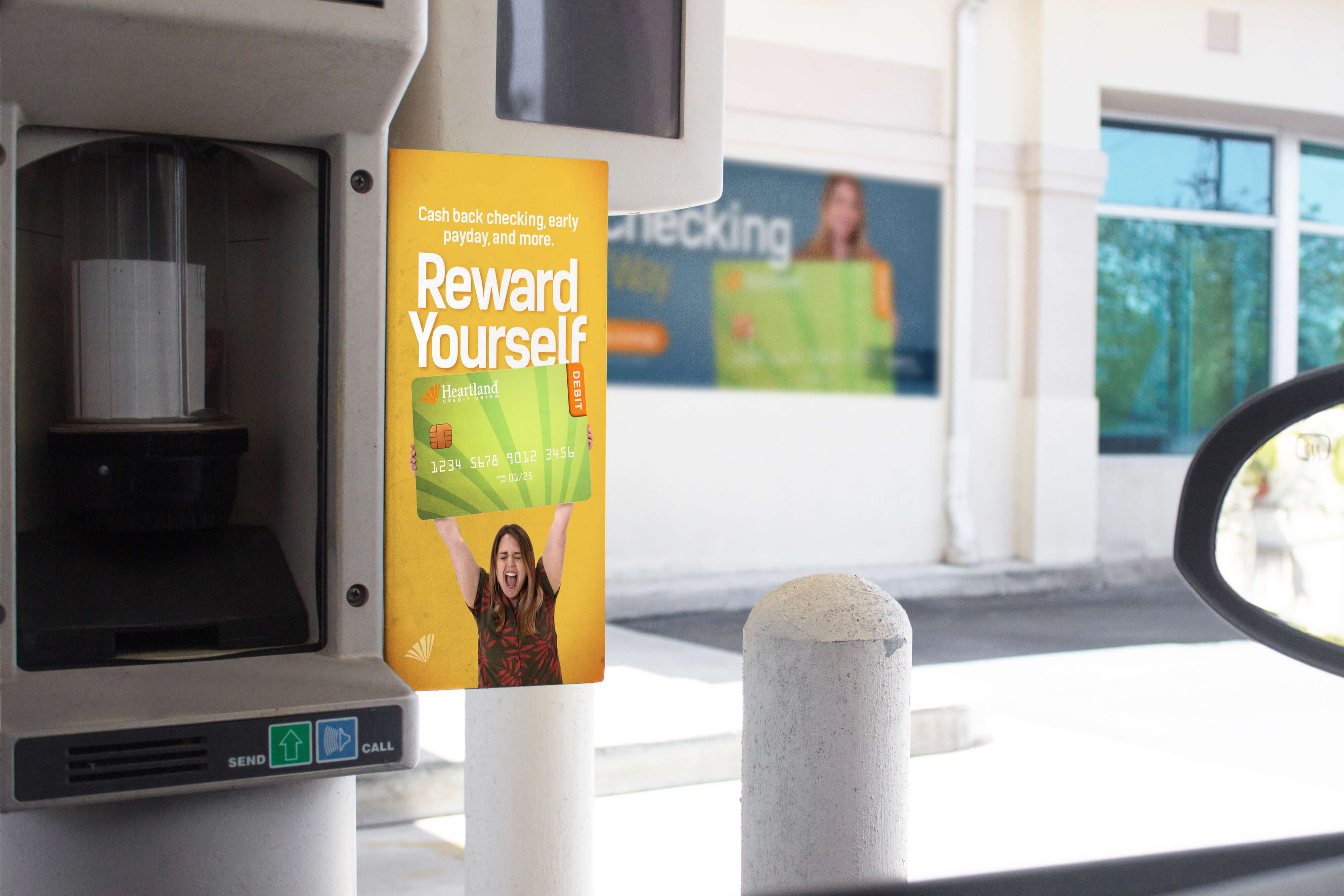

Word of mouth remains the most potent form of advertising. Howerton+White worked with the credit union to identify members who best represent consumer personas—from business owners to first-time homebuyers, youth account holders, and retirees—to leverage their stories as testimonials resonating with the desired audience. These actual members share their experiences through in-branch support materials direct mail pieces, digital ads, out-of-home, and videos.

Videos deployed on social media and streaming platforms feature members interacting with Heartland staff, recounting how the credit union helped them succeed in meaningful ways. The same members appear in static ads accompanied by messaging that defines and demonstrates “The Heartland Way.”

Creating Brand Consistency

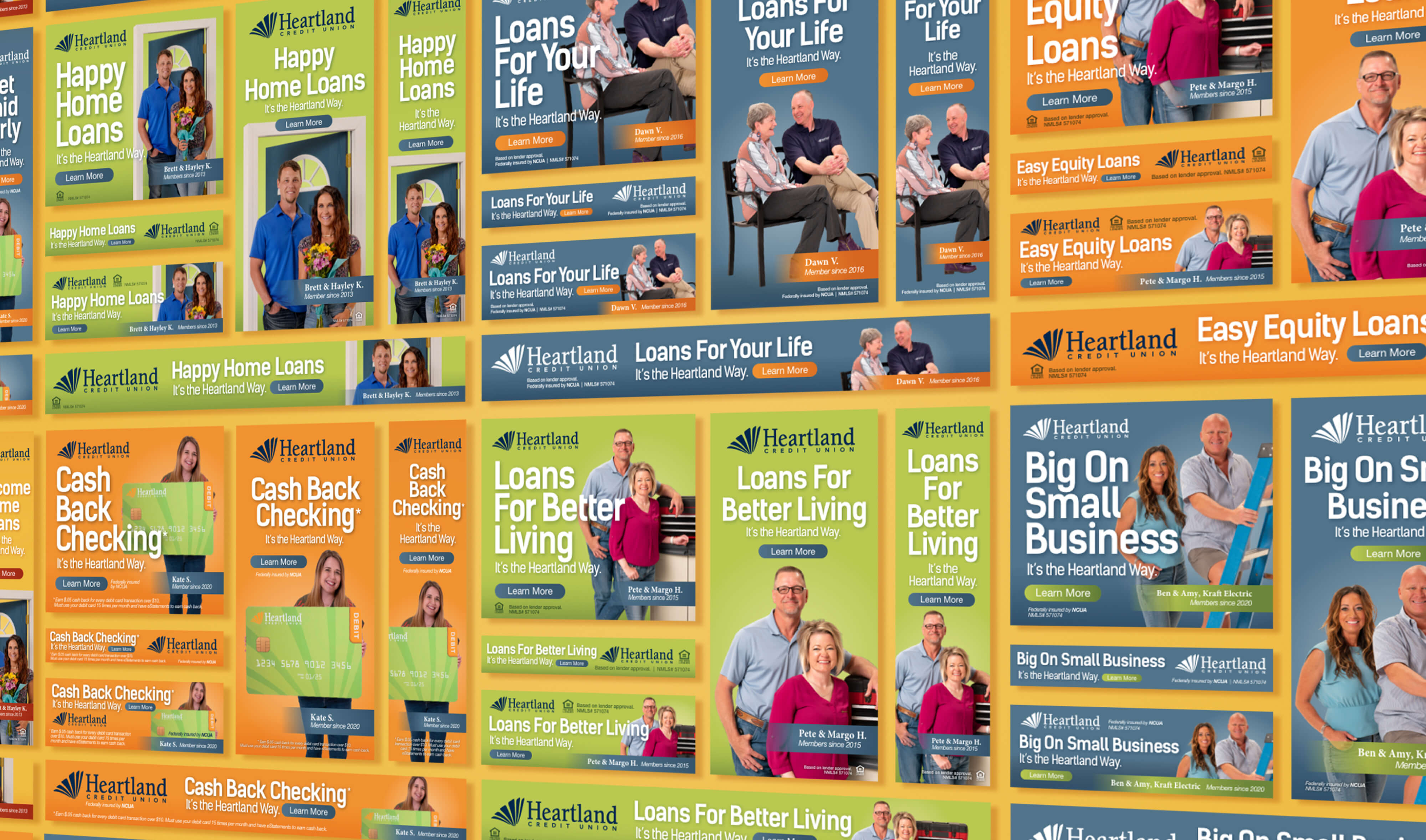

Howerton+White collaborated with Heartland’s in-house team to create templates and other assets supporting an omnichannel marketing campaign promoting its products and services. Brand boards established essential guidelines—including high-level messaging, color palettes, typography, imagery, and voice—that enabled both teams to collaborate and communicate the Heartland Way consistently.

Developing Digital Campaigns

In today’s digital landscape, banks face significant challenges in engaging with online audiences. Reports indicate that traditional financial institutions lag in digital marketing, with over 40% struggling to personalize content effectively. Recognizing this, Howerton+White and Heartland developed a comprehensive marketing plan to support their sales funnel and achieve annual business goals.

The plan encompassed awareness campaigns, targeted geographic initiatives introducing products and services, and conversion campaigns promoting special opportunities and deposits. Specific channel activation and clearly defined audience segmentation were key to supporting the engagement strategy. Extensive audience research provided insights into users’ distinct psychographic and demographic attributes, enabling precise targeting.

To ensure broad reach and optimized performance, assets were tailored for each placement, including social media, PPC, native display, contextual display, pre-roll video ads, streaming audio, and connected TV campaigns. Campaigns were strategically paced throughout the year on primary platforms before expanding to secondary ones. This approach prevented ad saturation among overlapping audiences while providing the layering and frequency needed to successfully engage each segment.

By addressing the prevalent challenges in the banking industry regarding digital audience engagement, Howerton+White helped Heartland Credit Union not only stand out in a crowded marketplace but also build meaningful relationships with its members. Through data-driven strategies and a commitment to authentic storytelling, the campaign exemplified how financial institutions can effectively reach and resonate with today’s digital consumers.